TRACTOR SUPPLY CO /DE/ (TSCO)·Q4 2025 Earnings Summary

Tractor Supply Misses on Revenue and EPS, Stock Drops 6% as Guidance Falls Short

January 29, 2026 · by Fintool AI Agent

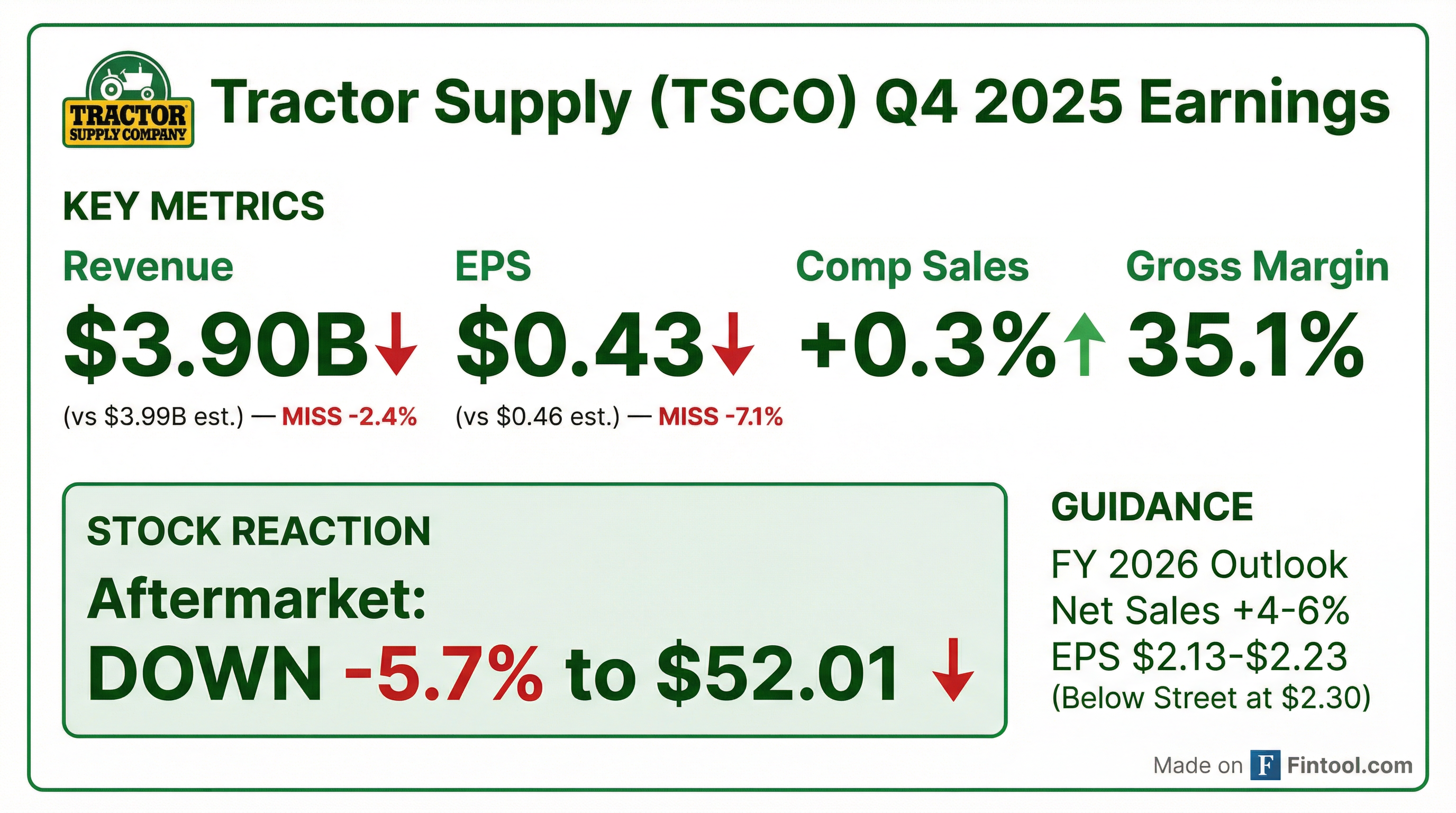

Tractor Supply Company (TSCO) reported Q4 2025 results that missed on both top and bottom lines, sending shares down nearly 6% in aftermarket trading. Revenue of $3.90 billion fell short of the $3.99 billion consensus, while EPS of $0.43 missed the $0.46 Street estimate. The rural lifestyle retailer also issued FY 2026 guidance below expectations, signaling continued caution amid shifting consumer spending patterns.

Did Tractor Supply Beat Earnings?

No. Tractor Supply missed on both key metrics:

The revenue miss was driven by weaker-than-expected comparable store sales of just +0.3%, compared to +0.6% in the prior year's fourth quarter. Management cited three primary drivers:

-

Hurricane cycling (~100 bps headwind): 2025 was a historically quiet storm season—the first time in a decade no hurricanes made landfall in the continental U.S. This created a meaningful lap versus 2024's Hurricane Helene and Milton recovery sales. The South Atlantic regions declined mid-single digits specifically from this effect.

-

Big-ticket step-down: Excluding emergency response, big-ticket categories experienced a step-down versus Q3 trends. Management believes this was category-specific rather than share loss.

-

Holiday weakness: Performance in seasonal holiday categories (holiday decor, toys, dog toys/snacks, power tools) fell below expectations amid a "highly promotional holiday environment."

On the positive side, Consumable, Usable, and Edible (CUE) categories delivered low- to mid-single digit comp growth, led by livestock, equine and poultry, and wildlife supplies.

What Did Management Say?

CEO Hal Lawton acknowledged the quarter "came in below our expectations" and attributed the shortfall to moderating discretionary demand:

"Our fourth quarter results came in below our expectations and reflected a shift in consumer spending, with essential categories remaining resilient while discretionary demand moderated. Against that backdrop, our team stayed focused on executing the fundamentals of the business, growing share in the farm and ranch channel and continuing to engage our customers."

On the full year, Lawton struck a more positive tone, highlighting strategic progress:

"Overall, 2025 was a year of meaningful progress. We continued to gain market share, opened productive new stores and advanced Project Fusion and localization. At the same time, we built the capabilities needed to support Direct Sales, Final Mile and pet and animal prescriptions."

Quarter Cadence

CFO Kurt Barton walked through how Q4 unfolded:

Average ticket increased 0.3%, driven by ~2 points of retail inflation from higher commodity costs and tariff flow-through, offset by softness in big-ticket categories.

What Did Management Guide?

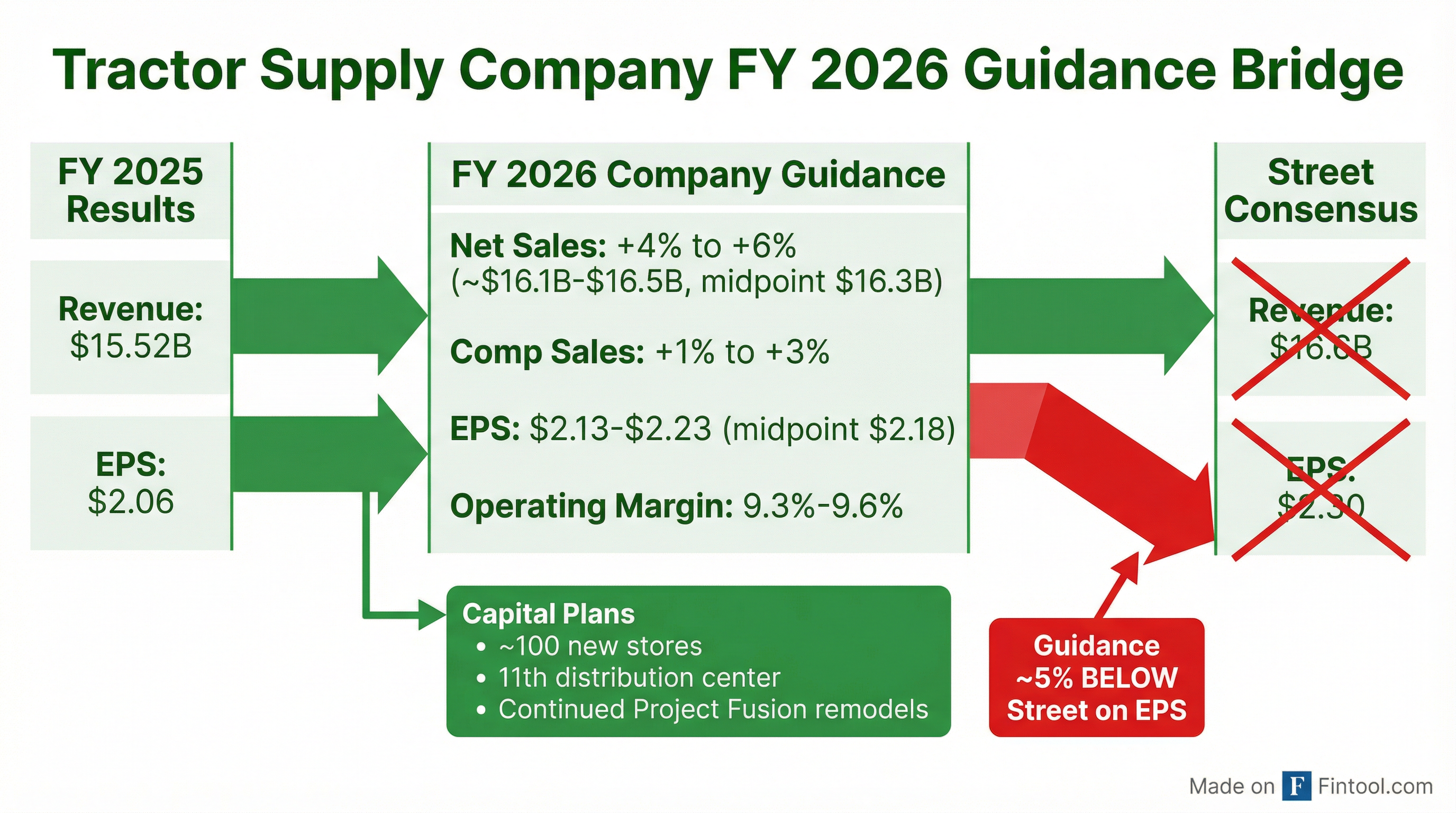

FY 2026 guidance came in below Street expectations:

The EPS guidance midpoint of $2.18 represents roughly 5% growth from FY 2025's $2.06, but sits ~5% below what analysts had modeled. This guidance gap was a key driver of the aftermarket selloff.

Capital plans for 2026 include approximately 100 new Tractor Supply stores, completion of the company's 11th distribution center, and continued investment in Project Fusion remodels and store technology.

Operating Leverage Inflection Point

CFO Barton provided a key framework for understanding the margin trajectory: the model shows an inflection point at the "low 2% comp range." As comps move above that threshold, operating margin improves roughly 5-20 basis points per year. With FY 2026 guidance of +1% to +3% comps, the company is targeting that inflection zone.

Q1 2026 Early Read

On the call, CEO Lawton provided color on how Q1 is tracking:

"We are tracking above our plan for the quarter to date. But there's still a lot of sales left to go. The month of January is ~30% of our sales. The month of March is ~40%."

Recent winter weather, including Winter Storm Fern, has supported demand across core categories. However, Lawton cautioned about volatility: "This week last year was the warmest in 35 years, and this year is the coldest in 35 years."

Management is also optimistic about tax refund season, noting it "could be very similar to 2018," with the majority of benefit landing in Q1.

What Changed From Last Quarter?

Several notable shifts emerged compared to Q3 2025:

Margin Pressure Intensified: Gross margin contracted 10 bps YoY to 35.1%, with management citing "higher tariffs, incremental promotional activity and increased delivery-related transportation costs." This marks a reversal from Q3's 37.4% gross margin.

SG&A Deleverage Continued: SG&A as a percent of sales increased to 27.5% from 26.8% in Q4 2024, reflecting planned investments and fixed cost deleverage on soft comp sales.

Operating Income Declined: Operating income fell 6.5% YoY to $297.7 million, translating to operating margin of 7.6% vs 8.4% in Q4 2024.

Tax Rate Benefit: The effective tax rate dropped to 19.0% from 21.5% last year, partially offsetting operating pressure.

How Did the Stock React?

TSCO shares fell 5.7% in aftermarket trading to $52.01, down from the regular session close of $55.14. The stock had already been under pressure, trading down 1% during the regular session ahead of earnings.

Historical context: This marks TSCO's second consecutive Q4 miss after Q4 2024's EPS miss. The stock is now down approximately 19% from its 52-week high of $63.99.

2025 Strategic Progress

The investor presentation and earnings call highlighted several milestones toward the "Life Out Here 2030" strategy:

Direct Sales: First $1M Specialist

The direct sales initiative gained significant traction. On the call, management revealed:

"In the month of December, we had our first $1 million specialist... Phone calls throughout the day, the relationship he had with his clients, everybody calling him, all the stuff they need. You can just see that relationship building."

Key direct sales metrics:

- December sales: $2M+ (eclipsed in January)

- Specialist count: ~50 at year-end, 9 hired in December/January

- External hires: 75% of specialists are external, averaging 11 years of farm/ranch experience

- 2026 comp contribution: Targeting ~40 bps from direct sales

Final Mile: Self-Funding Expansion

The final mile initiative is designed to be self-funding through freight savings. CEO Lawton explained:

"There is no incremental operating expense being attributed into that this year. Last year's benefits are paying for the rollout for this year... There are $10-ish million a year in savings that help both improve our gross margin and fund that initiative."

The initiative serves three purposes: lowering delivery costs, enabling direct sales, and building fulfillment capability for future demand.

Allivet: $100M Foundation

The pet and animal prescription business delivered approximately $100 million in sales for full-year 2025. While customer adoption progressed more gradually than expected initially, the business accelerated throughout the year. Focus for 2026 is deeper integration—embedding prescriptions in vet clinics, pet wash experiences, and strengthening the subscription offering on TractorSupply.com.

Key KPIs and Operating Metrics

Store Count: Tractor Supply operated 2,395 stores across 49 states as of quarter end, up from 2,296 a year ago. The company also operates 207 Petsense by Tractor Supply stores.

Capital Allocation: The company returned $238.9 million to shareholders in Q4 through $117.5 million in share repurchases and $121.4 million in dividends. For the full year, capital returns totaled $848.5 million.

Tariff Exposure

Management flagged tariffs as a gross margin headwind, with imports representing 13.6% of total sales—down from 14.8% a year ago. The forward-looking statements section specifically called out "the impact of the recent and potential future tariff announcements and the corresponding macroeconomic pressures" as a risk factor.

Full Year 2025 Summary

Despite the soft Q4, full-year results showed modest progress with revenue up 4.3% and comp sales improving to +1.2% from +0.2% in FY 2024.

Q&A Highlights

On discretionary weakness being transitory (Bobby Griffin, Raymond James):

CEO Lawton: "When we reflect back on the discretionary for Q4 and a bit of the step down that we saw there, we do think that was specific to Q4... A lot of it was emergency response, which is specific to that quarter. The second one was really around these seasonal holiday categories that we really only participate in Q4... Things like toys, some of the holiday decor, dog snacks and treats. We just didn't see that."

On tariff cadence (Kate McShane, Goldman Sachs):

CFO Barton: "We're basically halfway through the process of cycling through tariffs. Tariffs have had, at its base rate, anywhere from 20 or 30 basis points of pressure. We've been able to offset that through great cost management initiatives... We would anticipate that the impact in the first half to be very similar [to H2 2025]."

On pet food share concerns (Peter Keith, Piper Sandler):

Seth Estep (EVP): "We're not seeing any indication that we're losing share in pet... We might not be at the outsized pace that we were over the course of the last couple years, but we're holding our own, we're holding trips. Our customer remains very engaged. Last year, we saw over 2 million pets come through our pet washes. Our pet vet clinics grew in sales over 20%."

On when initiatives contribute meaningfully (Chris Horvers, J.P. Morgan):

CEO Lawton: "We expect those initiatives to provide material benefit this year in our comp... If you think about the number of reps and the pace we're running at, you can see the dollars that we would roughly be targeting this year, and that starts to have a material, 40-ish basis points impact on comp."

What to Watch Going Forward

-

Q1 Weather and Tax Refunds: Management is tracking above plan QTD with Winter Storm Fern support, but March (40% of Q1 sales) remains the swing factor. Watch for spring weather timing and tax refund season impact.

-

Direct Sales Ramp: With first $1M specialist achieved and ~40 bps comp contribution targeted, execution of the specialist rollout (50→100) is a key 2026 story.

-

Operating Leverage Inflection: At "low 2% comp," the company expects to hit operating margin inflection. The 1%-3% comp guidance straddles this threshold—watch for margin trajectory.

-

Tariff Cycling: Company is "halfway through" cycling tariffs with 20-30 bps base pressure. First half should see similar impact to H2 2025.

-

Chick Days and Spring Season: Expanded Chick Days (more stores, more weeks, online 365 days) is a key traffic driver. Two tough spring seasons create an easier comparison setup.

-

Pet Category Stabilization: While not losing share, pet food isn't contributing outsized growth. Watch for Freshpet expansion and 4Health brand refresh impact.

Tractor Supply hosted its Q4 2025 earnings call on January 29, 2026. This analysis incorporates the full earnings call transcript, 8-K filing, and investor presentation. Q1 2026 earnings will be released on Tuesday, April 21, 2026.

Related: TSCO Company Profile | Q3 2025 Earnings | Q4 2025 Transcript